Why Am I Not Paying Tax on My Wages in the UK?

Understanding why you’re not paying tax on your wages in the UK can seem confusing at first, but in many cases, it’s entirely legitimate. Whether you’re earning below the income tax threshold, using your tax-free allowances effectively, or affected by an incorrect tax code, there are several factors at play.

This comprehensive guide will walk through the most common reasons, clarify tax rules, and help you understand what to do if something seems off.

How Does the UK Income Tax System Work?

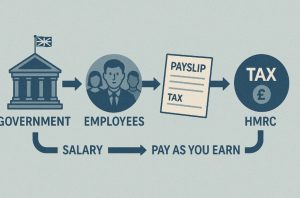

The UK’s income tax system is based on a progressive taxation model, meaning that higher earners pay a greater percentage of their income in tax. Income tax is typically collected through PAYE (Pay As You Earn) for employees, or through Self Assessment for the self-employed.

The Basic Components of Income Tax:

- Taxable income includes earnings from employment, self-employment, rental properties, pensions, and some savings or investment returns.

- HMRC is responsible for calculating, collecting, and refunding income tax.

- The tax year runs from 6 April to 5 April the following year.

- Tax is charged in bands, with different rates applying depending on how much you earn.

Income tax bands for 2024/25 in England, Wales, and Northern Ireland:

| Band | Taxable Income | Tax Rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic Rate | £12,571 to £50,270 | 20% |

| Higher Rate | £50,271 to £125,140 | 40% |

| Additional Rate | Over £125,140 | 45% |

The system ensures that people earning less than the personal allowance are not required to pay any income tax, which is why many people especially those in part-time roles, students, or starting new jobs—might not see deductions.

What Is the Personal Allowance and How Does It Affect My Tax?

The Personal Allowance is the amount of income you’re allowed to earn each tax year before paying any income tax. For the 2024/25 tax year, the standard personal allowance is £12,570. If your annual income is below this figure, you won’t be taxed on your wages.

Who Qualifies for Personal Allowance?

- Most UK residents automatically receive this allowance.

- Non-residents may still qualify, depending on income source and tax treaties.

- It reduces when your income exceeds £100,000, tapering by £1 for every £2 above that.

Example:

Let’s say a university student works part-time and earns £10,000 in the year. They are below the threshold, so they don’t owe any tax. Someone earning £14,000 would pay 20% tax on the £1,430 that exceeds the personal allowance.

This is one of the most common reasons why someone isn’t paying tax on their wages in the UK.

Why Might I Not Be Paying Tax on My Wages?

Not paying income tax on your wages may seem unusual, especially if you’re used to seeing deductions on your payslip but in many cases, it’s entirely legitimate. The UK tax system has built-in mechanisms and thresholds that determine when income tax is due.

If your earnings or circumstances fall within certain criteria, it’s perfectly possible (and legal) to earn without paying income tax. Let’s explore the most common reasons in detail:

1. Your Income Falls Below the Personal Allowance

The most frequent reason is that your total annual income is under the Personal Allowance threshold, which is currently £12,570 (as of the 2024/25 tax year).

For example:

- If you work part-time and earn £900 per month, that’s only £10,800 annually well below the taxable threshold.

- In this scenario, HMRC recognises that you are not required to contribute income tax, and your payslip will reflect £0 in tax deductions.

This threshold resets every tax year, so even if you work sporadically throughout the year or only for part of the year, you may stay within this allowance.

2. You’re Working a Part-Time, Temporary, or Low-Paying Job

Many people like students, carers, freelancers, or those with multiple responsibilities, work reduced hours or have irregular earnings. If you’re employed part-time, even at a standard hourly rate, your annual income may not breach the tax threshold.

Additionally, those with seasonal jobs (e.g., summer or holiday retail roles) might not accumulate enough income over the full tax year to trigger tax liabilities.

This can also happen if:

- You’ve recently returned to work after a break.

- You’re in a probation or training period with lower initial pay.

- You are on a zero-hours contract with no guaranteed hours.

3. You’re a Student with Limited Earnings

Students are not exempt from paying tax altogether, but most do not earn enough to exceed the Personal Allowance during their studies.

- Part-time campus jobs, internships, or vacation employment may only bring in a few thousand pounds per year.

- If a student earns more than the threshold, tax will be deducted just like for any other employee.

Additionally, student loans are not considered taxable income, and neither are most grants or bursaries.

4. Your Tax Code Reflects a Higher Allowance or No Tax Owed

The tax code assigned to you by HMRC informs your employer how much tax-free income you’re allowed to earn. The most common tax code in the UK is 1257L, which corresponds to the standard Personal Allowance.

However, other codes may apply:

- 0T: No allowances applied – could result in overpaying.

- BR: Basic rate applied – for second jobs.

- NT: No tax – used for certain temporary situations.

- K codes: Indicates tax from other income or benefits is being collected.

If your tax code is incorrect, it could mean you’re not paying tax when you should be, or vice versa. It’s crucial to check this code regularly, especially if you’ve changed jobs or had a break in employment.

5. You’ve Recently Started a Job and Payroll Hasn’t Updated

In some cases, HMRC and your employer may not have synchronised your tax details yet especially if it’s your first job or you’ve recently started.

It’s common for:

- The first few pay slips to show no tax until PAYE is set up.

- HMRC to apply an emergency tax code, which might temporarily result in no tax or higher deductions.

- Adjustments to be made later in the tax year to correct under- or overpayments.

Employers are required to submit your details via the Real-Time Information (RTI) system, but there can be delays.

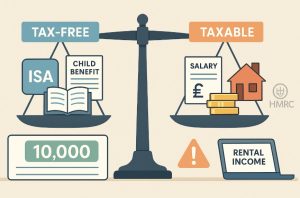

6. You Receive Certain Types of Non-Taxable Income

Not all forms of income are subject to income tax in the UK. If your wages are supplemented or replaced by tax-free income sources, you might not see tax deductions on your payslip.

Some examples of non-taxable income:

- Universal Credit or other state benefits

- Child Benefit (unless subject to the High Income Child Benefit Tax Charge)

- ISA interest or returns

- Scholarships or educational grants

- Gifts from family or friends

In cases where the bulk of your income is from these sources, you might still receive money regularly but not owe any tax.

7. You’re Being Paid in Cash or ‘Under the Table’ (Warning)

In less formal employment arrangements such as domestic work, casual labour, or small business gigs, some employers may pay workers in cash without reporting it to HMRC. This might result in no tax being deducted from your wages.

Important: Even if you’re paid in cash, you’re legally required to report all income to HMRC. Failure to do so can be considered tax evasion, which is a criminal offence. You may face penalties, fines, or prosecution.

If you’re self-employed or working under informal terms, it’s your responsibility to declare income via Self Assessment.

8. Your Employer Isn’t Registered for PAYE or Made a Mistake

In rare cases, an employer may not be registered properly with HMRC or might make payroll errors that result in tax not being deducted.

This can happen if:

- You’re working for a small or new company unfamiliar with PAYE.

- Payroll systems are out of date or improperly configured.

- Incorrect employee details (like NI number or start date) were provided.

In such situations, you may end up underpaying tax unknowingly, which could result in a bill from HMRC later on. It’s best to contact both your employer and HMRC to investigate further.

What Is the PAYE System and Why Aren’t Deductions Showing?

The PAYE system is designed to automate tax collection. Employers deduct tax and NIC directly from salaries before paying employees. If your payslip doesn’t show tax deductions, here are some possibilities:

- Your income is within the tax-free allowance.

- Your employer hasn’t submitted payroll info to HMRC yet.

- An incorrect or “cumulative” tax code has been used.

- You started or changed jobs recently.

Payslips typically show:

- Gross pay

- Tax code

- Tax paid

- National Insurance contributions

- Net pay

It’s wise to keep track of each payslip and compare them over time.

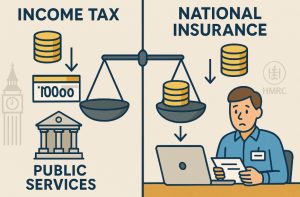

What’s the Difference Between National Insurance and Income Tax?

Many people are confused when they see deductions for National Insurance (NI) but not for income tax. While both are mandatory in many cases, they serve different purposes.

| Category | Income Tax | National Insurance |

| Purpose | Government revenue | State benefits funding |

| Threshold | £12,570 | £12,570 (Class 1) |

| Required for | Almost all UK earners | Workers aged 16–State Pension age |

| Applies to | Most types of income | Employment/self-employment only |

You can earn enough to trigger NI payments but still not owe income tax if you’re earning between the two thresholds.

Should I Be Paying Tax and How Can I Check?

If you’re unsure about your tax status, it’s important to confirm whether you should be paying tax. Mistakes can happen.

Here’s how to check:

- Check your tax code: Found on your payslip (e.g. 1257L means you’re entitled to the full personal allowance).

- Log in to your HMRC account: See your income history, tax code, and if any underpayments/overpayments exist.

- Use HMRC’s online calculators: To estimate if you’re under or over the threshold.

- Contact HMRC directly: If you suspect an error or haven’t been assigned the correct tax code.

Ignoring these details can lead to unexpected tax bills later, especially if HMRC reviews your account and discovers underpayment.

How Can I Fix My Tax Situation If There’s a Mistake?

If you discover you should be paying tax but aren’t, or you’re on an incorrect tax code, you can take steps to correct it.

What You Can Do?

- Speak to your employer’s payroll team: They may correct the code internally if instructed by HMRC.

- Call or write to HMRC: Ask for a tax code review.

- Use your personal tax account: Submit updated employment or income details.

- Claim a refund: If you’ve overpaid, use a P800 form or online claim.

HMRC can reclaim unpaid tax across multiple years, so it’s essential to resolve any anomalies quickly.

What Types of Income Are Tax-Free in the UK?

Some income sources do not attract tax liability. Here’s what you might receive without triggering tax obligations:

- Premium Bond winnings

- Certain bursaries or scholarships

- Child Tax Credit or Universal Credit

- Dividends under £1,000 (Dividend Allowance)

- Interest from ISAs or Premium Bonds

You still need to report some of these on your tax return, especially if you’re self-employed or have multiple sources of income.

Are There Other Reasons Why I’m Not Being Taxed?

There are a few less common, yet entirely legitimate, reasons why someone might not pay tax:

- You’ve just started your first job: PAYE deductions may take a few weeks to align.

- Multiple jobs: You may use your entire personal allowance on one job, leaving the second taxable.

- Employer not processing PAYE: This may be due to delays or admin issues.

- Pension contributions: Salary sacrifice schemes can reduce your taxable income.

If any of these apply to you, it’s worth double-checking your HMRC account or reaching out for guidance.

What’s the Bottom Line If I’m Not Paying Tax on My Wages?

If you’re not paying income tax on your wages in the UK, it’s often because you legally don’t have to. As long as your income is within allowable thresholds and your tax code is accurate, you’re in the clear.

However, if you’re unsure or something doesn’t add up, don’t leave it to chance. Mistakes can result in tax bills, fines, or delays in repayments. Be proactive and keep your records updated.

What Are the Differences Between Taxable and Non-Taxable Income?

| Income Type | Taxable? | Notes |

| Full-time employment salary | Yes | Above personal allowance |

| Part-time student job (under £12.5k) | No | Income below tax threshold |

| State pension | Yes | Depending on total income |

| ISA interest | No | Completely tax-free |

| Child Benefit | No | Taxed only if one parent earns over £50k |

| Rental income | Yes | Over £1,000 per year |

| Scholarship or educational grant | No | If used for course-related expenses |

FAQs

What is the minimum salary to pay tax in the UK?

Currently, any salary below £12,570 is not subject to income tax due to the personal allowance.

Can my tax code affect whether I pay tax or not?

Absolutely. Tax codes tell your employer how much tax-free income you’re entitled to. An incorrect tax code can result in no tax being deducted or too much tax being paid.

Why am I paying National Insurance but not income tax?

You might be earning just above the NI threshold but still below the income tax threshold, which is why only NI is deducted.

Do students pay tax on part-time jobs?

Students pay tax like everyone else, but if their total annual income is under the allowance, they won’t pay income tax.

How can I find out if HMRC owes me a tax refund?

Log in to your HMRC account or wait for a P800 form which outlines if you’ve overpaid and are due a refund.

Will I be penalised for not paying tax if it was HMRC’s mistake?

You may still need to pay the amount owed, but you’re less likely to be penalised if it was HMRC’s or your employer’s error.

What happens if I’ve been paid in cash and haven’t paid tax?

If the income hasn’t been declared, it may count as tax evasion, which carries fines and penalties. Always declare your income.